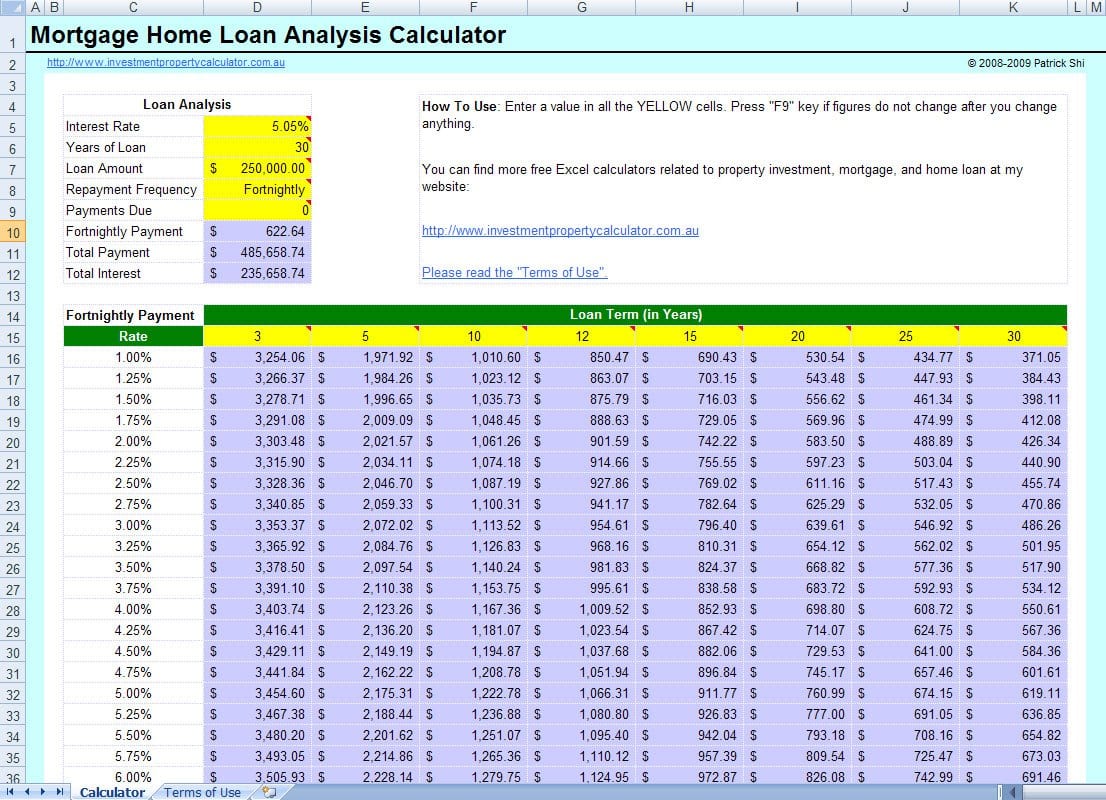

The target audience of excel calculator templates includes all organization, businesses, real estate agencies, financial companies, banks, government offices, schools, institutions as well as individuals. > What are the Target Audience of Excel Calculator Templates? The core aim of these basic templates is to serve various businesses, organizations as well as individuals to maintain different types of records conveniently. These are utilized to carry out calculations automatically for all the records added in the excel sheet, thus lessening your burden of doing long calculations. Whether it is about calculating monthly or annual leaves of the employees or calculating revenue or profit of the organization, these excel calculator templates are perfect to be used for all such reasons. We can visualize the impact with a nice chart (requires some extra work) like this:ĭo check the download workbook for details on how the chart is setup.Download > What are the Utilities of Excel Calculator Templates?Ĭalculations are involved in almost every department, organization or our day to day life as well. Go ahead and play with the table by typing some values in the “Extra payment” column. Step 3: Your mortgage will end when the “Eff.

Extra Payment is the input column where we can type any extra payments.

We can get this with the PPMT() function. Principal Paid is the amount of principal paid in each month.=ROUND(NPER($E$7/12,$E$10,$D13),0) will tell us how many months it is rounded. We can use NPER function to get the answer here. Effective term is how long it would take you to pay off the mortgage based on the opening balance, and agreed upon monthly payment (calculated in Step 1) and interest rate (Cell E7).For subsequent months, this will same as previous month’s closing balance. Opening Balance is same as loan amount for month=1.Related: Read about SEQUENCE and other Dynamic Array functions in Excel. You can use =SEQUENCE(360) to automatically generate all the months. So, set up a range of 360 months (or longer if you want to cater for longer mortgages).

In my case, let’s say loan is $500,000, term is 20 years and APR (Interest rate) is 5.35% per annum.Īs extra payment will bring down the outstanding loan term, we need to set up an amortization table to see the impact clearly. Step 1: Calculate the monthly (or weekly / fortnightly) payment:Īssuming you have the Loan amount, term & APR in three cells E5, E6 & E7, we can use the PMT() function to calculate the periodic payment.

0 kommentar(er)

0 kommentar(er)